The Basics of Business Interruption Insurance

11/1/2021 (Permalink)

Business Interruption Insurance Fundamentals

Many business owners in Glendale, AZ, have disaster insurance, commercial building insurance and even personal property insurance, but not many consider business interruption insurance. Interruption coverage can be as crucial as a flood or disaster policy, and perhaps even more so. Whereas most insurance policies cover physical damages, they do not cover intangible losses, such as lost revenue and lost customers, that are the result of a closed business or a necessary rebuild. If you don’t have interruption coverage for your business, here are a few good reasons you should consider purchasing a policy today:

- It covers lost income that results when you are forced to leave the premises for an extended period.

- It covers the revenue you would have earned based on earning reports from previous years.

- It covers operating costs that may or may not continue post-disaster, such as electricity.

Cover Your Bases With a Sound Policy

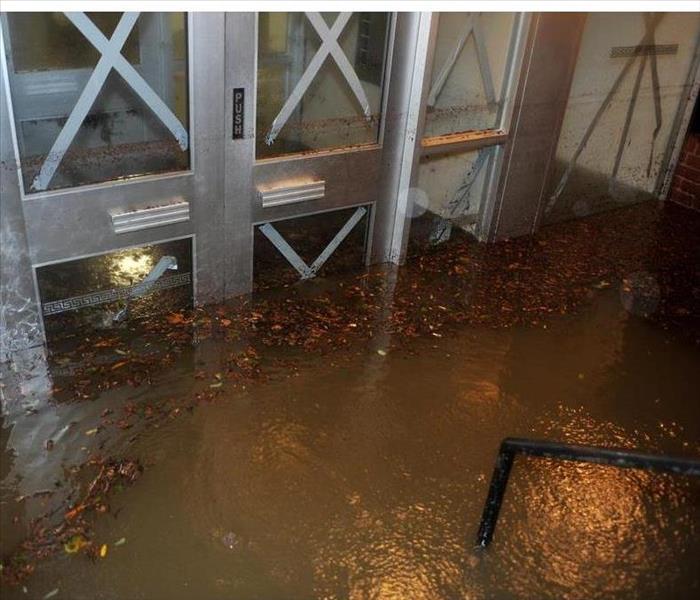

Unfortunately, there is no telling how long you will be out of business post-disaster. If your building was subject to a flood, you may only be closed for the week that it takes the water remediation team to clean out your structure and its contents. However, if your Glendale, AZ, building was in the path of a tornado or a hurricane, you may have to rebuild entirely, which could take months.

Even a week of lost income can be financially damaging; months of lost revenue can mean the end of your business. Bearing that in mind, you should consider investing in a policy that covers your company for more than a few days. Most business interruption policies allow the insured to cover losses for a period of restoration up to 720 days.

Don’t Let a Disaster Close Your Doors — Get the Coverage You Need

If you live in a disaster-prone area, the smartest thing you can do for your business and your livelihood is to invest in interruption coverage. The right policy can cover losses during the entire time it takes to rebuild and reopen your doors.

24/7 Emergency Service

24/7 Emergency Service